PPAI Research: Suppliers Face Revenue Struggles

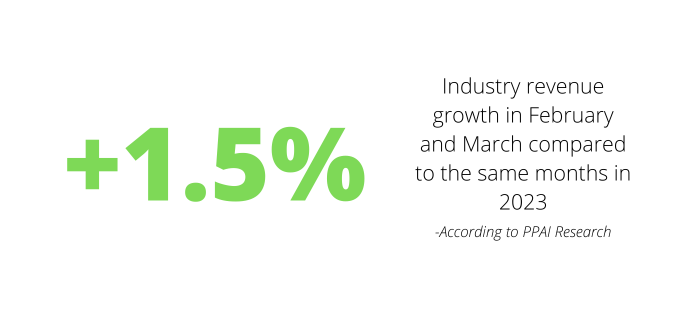

In PPAI Research’s series of bi-monthly snapshots, the promotional products industry seems unable to shake its modest pace of revenue growth. In February and March, the industry grew by 1.5% over the same period in 2023.

- This is only a slight improvement on the 1.4% growth registered in December and January.

- Perhaps more importantly, it continues to stay below half the rate of inflation, which rose to 3.5% in March according to the U.S. Bureau of Labor Statistics.

- The latest revenue data isn’t cultivated from the same methodology as the annual Distributor Sales Volume Estimate, which polls distributors of all sizes. Rather, the current assessment stems from the aggregated results of PPAI 100 suppliers responding to a flash survey.

Alok Bhat, PPAI’s market economist and research lead, says that maintaining growth leaves plenty of room for a promising future, but it also puts many promo companies in a position in which nimble maneuvering is crucial going forward.

“The industry's modest growth – lagging behind inflation – underscores the challenges of expansion and the necessity for cautious optimism, adaptation and innovation in a fluctuating economic landscape,” Bhat says.

These challenges are underscored by the reveal that 41% of suppliers reported a revenue dip in February and March 2024 compared to the same stretch of 2023. Markedly, a much smaller share of distributors – 20% – reported a revenue decline in February-March.

“Distributors seem to be outpacing suppliers in capturing sales revenue growth, likely benefiting from direct consumer insights and agile market response capabilities,” Bhat says.

The share of suppliers reporting an increase in unit sales (39%) mirrored, roughly, the share reporting a decline in unit sales. In another sharp contrast, 65% of distributors reported an increase in unit sales in February-March.

Andrew Titus, president of Fully Promoted – ranked the No. 18 distributor in the inaugural PPAI 100 – says the West Palm Beach, Florida-based company has experienced a slight increase in sales revenue, partly due to unit growth.

“Our numbers will mostly likely skew higher than average in the next six months as we have a record number of new locations being launched,” Titus says.

Order volume tells a similar tale as unit sales. Among suppliers, 46% reported an increase in order volume in February-March and 33% reported a decrease. Again, the numbers are much better for distributors, 70% of which reported an increase in order volume and only 10% report a dip in order volume.

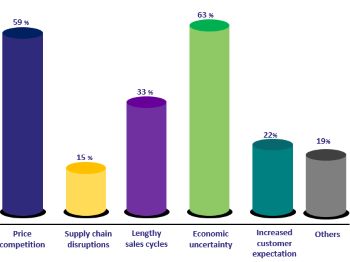

Supplier Challenges

“Economic uncertainty” remains the most commonly reported business challenge facing suppliers. However, the number of suppliers who cited the economy dropped significantly in February and March down to 63%, compared to 82% in December and January.

- Concerns over the economy have softened notably over the past six months. The number of suppliers citing the economy as a challenge was 91% back in October and November.

With the economy seeming to stabilize in the minds of suppliers, something else is perhaps behind their recent revenue struggles. It is worth noting that the number of suppliers who answered “Others” to what business challenges they faced has gone up to 19%, implying a diverse set of unique challenges.

That 19% underscores how numerous possible obstacles can pop up for suppliers, affecting – at least temporarily – their bottom line.

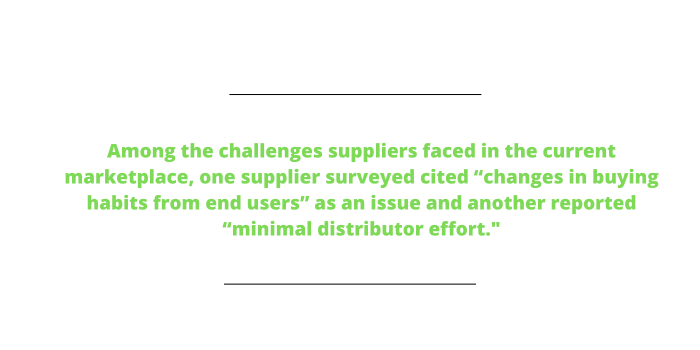

- One anonymous supplier stated a new ERP launch in the first week of February, “which is a good thing, but we intentionally cut off rush and prolonged production time during the transition, which translated to changes in order, revenue and units sold.”

- Another supplier cited “changes in buying habits from end users” and still another reported “minimal distributor effort” becoming a challenge.

Also of note is a significant increase in suppliers claiming that price competition pressure as a business challenge, which at 59%, nearly doubled the shareof suppliers (32%) citing that issue in December and January.

According to Bhat, this newfound focus on price competition suggests “a highly competitive market environment where cost efficiency and value proposition become pivotal.”

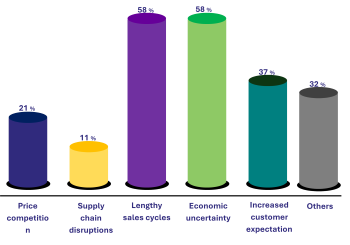

Distributor Challenges

Similar to their supplier counterparts, PPAI 100 distributors cite economic uncertainty and lengthy sales cycles as their biggest business challenges.

- Matching the trend among suppliers, distributors’ concerns over the economy have also significantly decreased over the past six months. In February-March, 58% of distributors reported it as a challenge, compared to 94% in October-November.

The same share of distributors (58%) are reporting long sales cycles as a hurdle, which may reflect decision-making delays or complexities in procurement processes.

Titus adds that the political climate is the next biggest challenge facing promo firms. “Both candidates are polarizing, which is impacting how some businesses are choosing to spend their budgets,” Titus says.

More than one-third (37%) of distributors – up from 32% in December and January – reported rising customer expectations as a major challenge, indicating a shift towards higher service standards and product quality in the industry.

- Meanwhile, price competition, which in October and November had affected a third of distributors, has since stabilized and is now considered a challenge by only 22%.

Nearly one-third (32%) of distributors who answered “Other” highlighted unique challenges, such as adapting to digital transformations, navigating labor market shifts and ensuring quality control from suppliers.

One anonymous distributor said that “RFPs continue to become more complicated” and that they “often see greenwashing and a lack of transparency from suppliers on sustainability.” Another distributor mentioned “facing a slowdown in customer demand.”

Jo Gilley, CEO of Overture Promotions – ranked the No. 15 distributor in the inaugural PPAI 100 – considers the pace of change to be a challenge for the Waukegan, Illinois-based company.

“As we continue to improve technology, automate workflows and add AI into the mix, we have to keep it manageable to be able to train employees and normalize new ways of doing things,” Gilley says. “Ensuring remote and hybrid employees stay engaged and a part of the culture is an ongoing, low-grade challenge.”

Gilley hopes that Overture’s “homecoming week,” in which everyone comes to headquarters for three days’ worth of training, awards, a town hall and a “spring fling” party, will fuel camaraderie throughout the organization this week and beyond.

“The building is humming with energy, and it makes me deeply happy,” Gilley says.