PPAI Sales Volume Estimate: A Record Year, But Few Celebrating

(Editor's Note: Since 1965, PPAI's Distributor Sales Volume Estimate has been the most trusted, directionally accurate measure of the size of the U.S. promotional products market and trends in the industry. Selected charts displayed in this article are taken from the full report, available to members at PPAI's Professional membership tiers – Silver, Gold and Platinum.)

Last year, when the 2022 Distributor Sales Volume Estimate was published, it was a cause for celebration. For the first time ever, the promotional products industry accounted for more than $25 billion in revenue. Even with plenty of factors attributing to that number, the milestone showcased promo’s tremendous growth and economic recovery.

Now we know that 2023 was another record year for promotional products. But most of us are too tired and stressed to go to the party.

The latest version of PPAI's long-running study shows that promo's revenue topped $26 billion in 2023. While another milestone, this represents a net negative for the industry. The growth rate for 2023 was 2.24%, failing to outpace inflation, which has not dipped below 3% since March 2021 according to the Consumer Price Index report.

The results reflect similar trends reported on by PPAI Research’s bi-monthly surveys. While 2023’s revenue total is nothing to sneeze at and shows the large presence that the promotional products marketplace holds, industry professionals aren't exactly popping champagne.

“Promo’s revenue totals in 2023 show that the industry is healthy, but growth has tapered off since 2022’s explosive returns,” says Alok Bhat, market economist and research lead at PPAI. “Business strategy will be important going forward and capitalizing on upward trends is advisable.”

The Sales Volume Estimate also tracks the measured progression of several promo industry trends over the past year. These include larger distributors’ capture of a slightly bigger share of sales than they did in 2022, and the continued climb in prominence of sustainable products in the market.

For nearly 60 years, PPAI has been collecting, analyzing and reporting distributor sales. This annual study, prepared by independent research firm Relevant Insights, is the most definitive and comprehensive of its kind in the industry. It is a valuable resource for understanding the current landscape for promotional products companies and as a potential tool in any attempt to try to prepare for the future.

Key Findings

As mentioned above, in 2023, the promotional product industry demonstrated a 2.24% growth rate over 2022. While positive, this is a significant step back from 2022’s growth rate of 15.6% and 2021’s growth rate of 12.5%. Growth has slowed, but it’s worth noting that those two years were part of a recovery from the 2020’s revenue totals, which was an outlier year due to the effects of the COVID-19 pandemic on the market.

In total, promo’s revenue reached $26.09 billion in 2023. Taking a macro-perspective, this shows promo revenue has grown by $6 billion over a 10-year period.

Company Size Comparisons

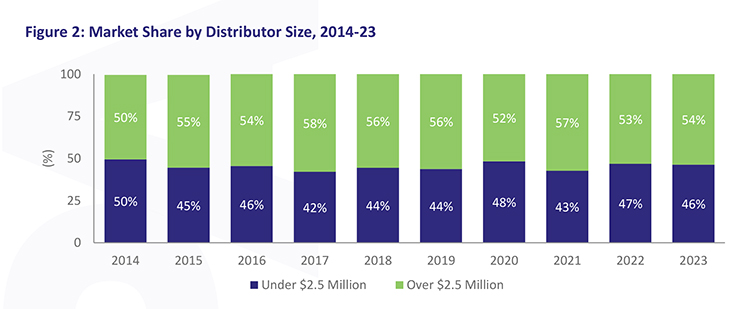

One year ago, we were talking about the strides made by small businesses – companies reporting under $2.5 million in annual sales – an encouraging trend after the hit such distributors took in the initial stage of the pandemic.

In 2023, the share of total sales by the smaller distributors took a slight dip to 46.3% (down from 46.8%).

Large distributors (over $2.5 million) captured $14,019,015,692 of the industry sales volume – a 53.72 percent share. It should be noted that the large-company segment also includes large franchisors that report for their franchisees. Sales from smaller distributors as a group amounted to $12,075,896,471 (see Figure 2).

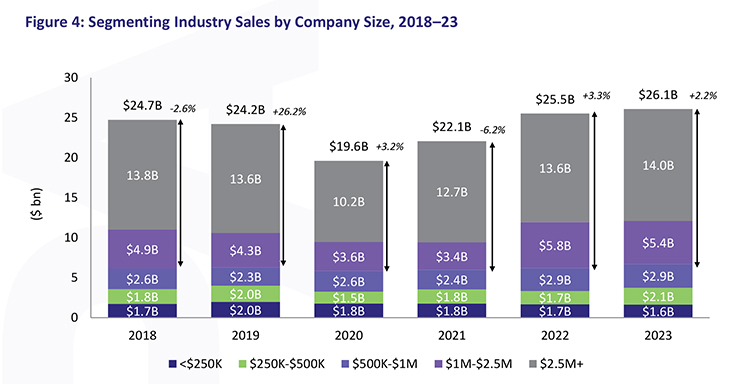

Changes in sales volume showed high variability in 2023. Within the small distributor segment, companies with sales between $250K and $500K experienced the greatest sales growth, while distributors at each end of that segment saw a decline in sales (see Figure 4).

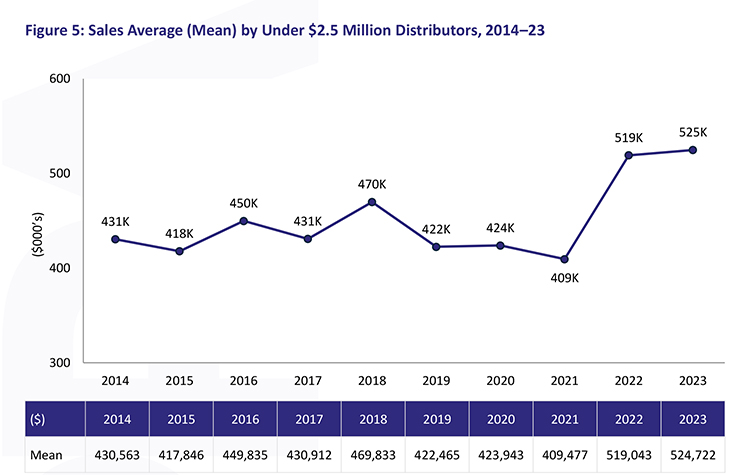

The average revenue for the small distributor segment slightly increased to $524,722 in 2023, up from $519,043 in the previous year, indicating steady performance within this cohort. (See Figure 5). The significant increases in 2022 and 2023 could potentially be a result of consolidation among the smaller businesses in the industry, with distributors buying out their competitors’ books of business following challenges exacerbated by the pandemic.

Online Sales

In 2023, online sales – which include transactions completed through online stores or distributor websites – amounted to $5.03 billion ($5,027,614,753), making up 19.3% of the promotional products industry’s total sales.

In 2023, 81% of large distributors and 58% of small distributors reported engaging in online sales.

Sustainable Products Continue To Rise

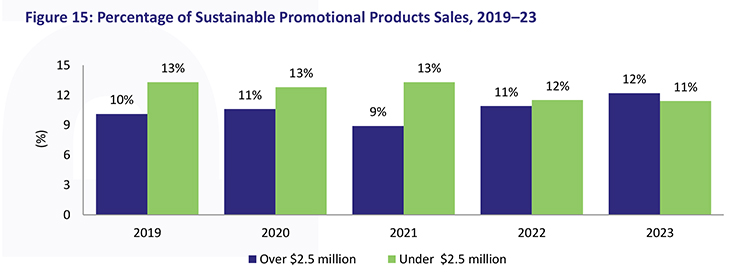

In 2023, sales in the sustainable products category, which includes items recognized for their eco-friendly attributes at various stages of their lifecycle – from production and usage to disposal – reached an estimated $3.09 billion. (See Figure 15.)

Accounting for 12.2% of the promotional products industry's total sales, the sustainable products segment saw an 8% increase from 2022’s figure of approximately $2.86 billion, underscoring a growing consumer preference for environmentally responsible options.

Sales by Product Categories And Industries

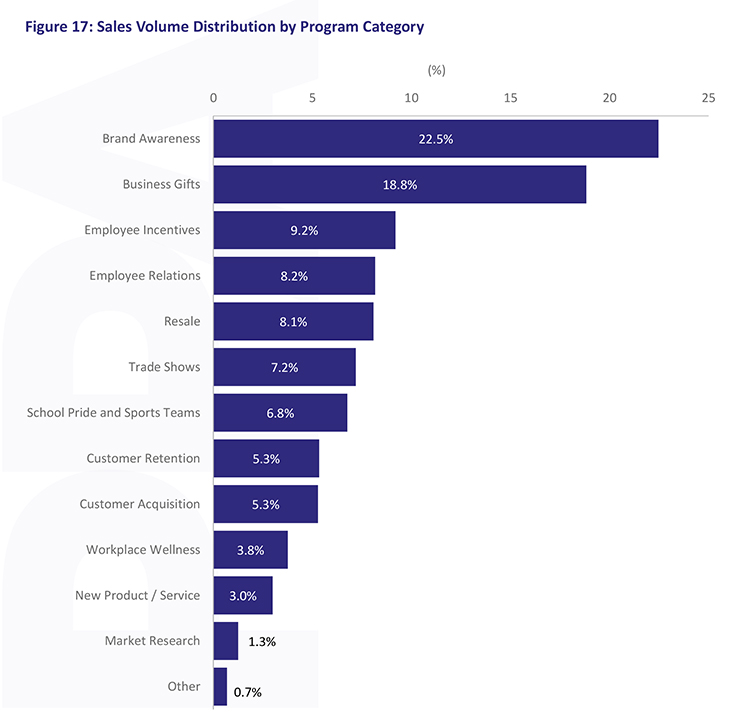

As was the case in recent years, apparel was the most commonly sold promotional product category by a healthy margin, making up more than a quarter of all sales. Drinkware once again came in second. (See Figure 17)

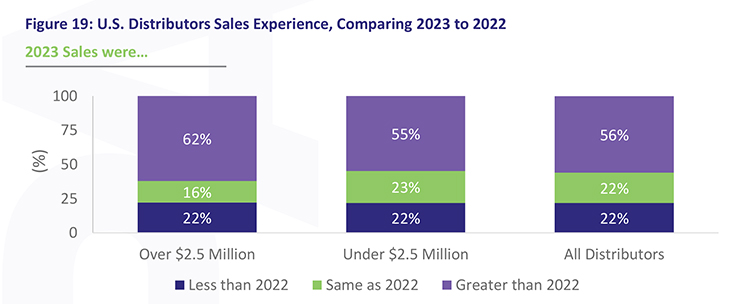

The range of industries buying promotional products showed a diversity of markets that promo is reaching. Business services (B2B) led the pack with education and healthcare rounding out the top three. (See Figure 19.)

2024 Expectations

A majority of distributors (63%) are bullish about their sales going up in 2024. That number jumps to 78% when it comes to large distributors.

However, the share expecting higher profits this year is lower. Among all distributors, 57% predict higher profits in 2024, with 68% of large companies anticipating profit growth. Improved business practices lead distributors' reasons for optimism. (See Figure 23.)

Among distributors who do expect positive profit growth in 2024, many are basing their predictions on increased business development efforts and investment in advertising and marketing to bring new customers. Only 3% forecast better economic conditions in the current year.

Of those who are expecting less profit in 2024 (8% of distributors), the economy was the most common reason behind their prediction. Additionally, more than one in 10 of this group (11%) cite plans to scale down their business for their 2024 profit expectations. (See Figure 25)

How The Study Was Conducted

PPAI’s Annual Estimate of Distributors’ Sales figures is based on an independent email/mail survey of industry distributors (including PPAI members and non-members) conducted from December 2023 to January 2024 by Relevant Insights, an independent market research firm.

In addition, a census of the largest firms was also undertaken. Responses projected across the entire distributor population combine sales for small distributors (under $2.5 million) and large distributor firms (over $2.5 million) to determine the total promotional products dollar volume.