PPAI Consumer Study: Why Promo Clicks With Gen Z

[Editor's Note: Want to take in all of PPAI Research's findings on Gen Z and promo at a glance? Check out this handy infographic laying out the must-know details from the Association's recent survey.]

Considering young consumers’ desire for branded merchandise, the future of the promotional products market is promising.

After all, Gen Z – the demographic that comes after millennials and generally accounts for people born between 1997 and 2012 – consistently engages with promo. More than one-third (34%) say they use promo products weekly and 21% say they use them daily, according to PPAI’s latest consumer survey.

Gen Z also understands the power of promo, as 68% report that branded merch has a positive impact on brand perception and 63% say they’ve purchased a product or service influenced by a promotional item. Furthermore, more than half (51%) follow brands specifically for their promo products or giveaways.

“Promotional products play a crucial role in shaping brand image and fostering loyalty among Gen Z,” says Alok Bhat, PPAI market economist and senior manager of research. “Their regular use further underscores the importance of selecting practical, appealing items that align with consumer lifestyles and preferences.”

The online survey captured insights from a nationally representative sample of more than 500 U.S. consumers between the ages of 18 and 26. The data collected from the survey indicates Gen Z’s promo preferences, emphasizing the importance of designing and marketing items that align with their core values.

“This data reinforces what we’re seeing in the field, and it shows where the industry is going,” says Nicole Baker, a 2022 PPAI Rising Star and account executive at Glenwood, Minnesota-based American Solutions for Business, ranked the No. 9 distributor in the inaugural PPAI 100.

Trend Seekers

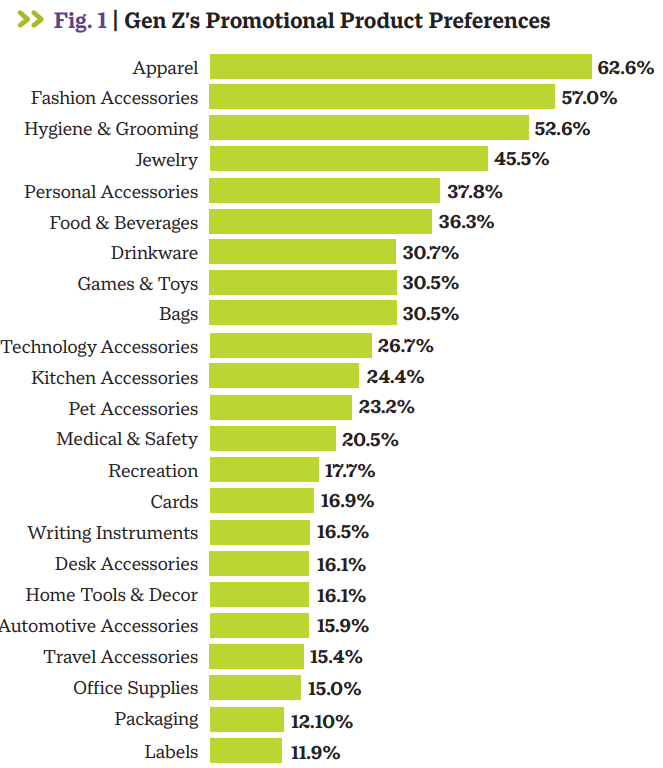

Apparel (e.g., shirts, polos, pants, dresses, activewear, outerwear, etc.) is the most popular promotional product (63%) among Gen Zers, followed by fashion accessories (57%) and hygiene/grooming products (52.6%), highlighting a trend towards stylish, health-conscious and functional items (see Fig. 1).

- Apparel is also the No. 1 promotional product (68%) that consumers of all ages have acquired in their lifetime, according to PPAI’s 2023 Consumer Survey.

Meanwhile, quality remains a key driver for brand loyalty, as 90% of Gen Z consumers are likely to recommend brands with high-quality promo products.

“I’ve seen a huge shift away from budget items to a focus on quality and on-trend products,” Baker says. “We’re also doing a lot more campaigns with multiple pieces, kits and an online component, as well as less transactional purchases. This data is a really exciting look at how and what we need to be selling if we want to stay competitive.”

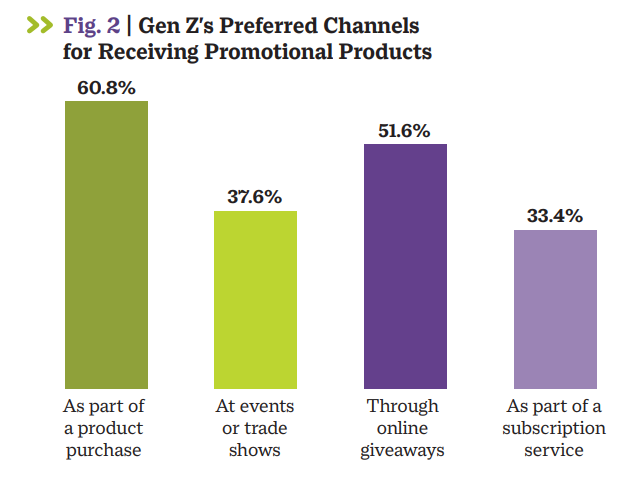

Tailoring your distribution strategy to Gen Z’s preferences can enhance brand engagement and customer satisfaction. For example, while most Gen Zers (61%) prefer receiving promo products as purchase incentives, 52% favor online giveaways (see Fig. 2). More than a third (38%) appreciate receiving them at events or trade shows and 33% like them as part of a subscription service.

“They love online giveaways, but usually only when the prize is something covetable and brand name,” says Samantha Fullerton, senior account executive at Los Angeles-based BAMKO, ranked the No. 4 distributor in the inaugural PPAI 100.

“They’re trend seekers who want premium quality merchandise. They’re not afraid of spending more money on quality products and they want what they want. They’re extremely particular about the fabrics and finishings, and logos are expected to look high-end and be inspired by retail logo/branding styles,” Fullerton says.

Gen Z’s Core Values

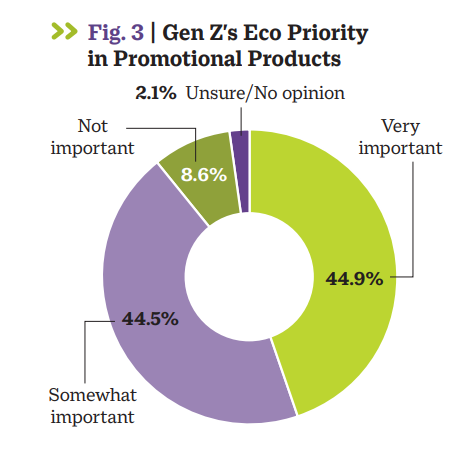

With 89% of Gen Z consumers believing sustainability to be important, it’s vital that promo firms prioritize eco-friendly products to meet this growing demand (see Fig. 3).

“To capture Gen Z's attention, brands must pivot towards eco-conscious products,” Bhat says. “Their pronounced preference for sustainability is now a cornerstone in shaping product development and marketing strategies.”

Roughly 82% of Gen Zers consider environmental impact to some degree when using promo products, which means that brands should focus on the environmental footprint of their goods, including packaging and lifespan, to align with these consumers’ values.

“Gen Z consumers understand that they vote with their purchases and expect to be able to make informed buying decisions,” says Elizabeth Wimbush, director of sustainability and responsibility at PPAI. “They don't want to just buy stuff; they want to influence positive change with their spending. Brands and companies that focus on educating their buyers about their environmental and social initiatives will continue to gain market share as this trend becomes the standard.”

With 81% of Gen Zers valuing diversity, equity and inclusion (DEI), companies should ensure their promotional products and marketing campaigns are inclusive and reflective of diverse perspectives. Emphasizing DEI can enhance brand reputation and appeal, particularly to socially conscious consumers.

“We see the Gen Z crowd pushing for more sustainable goods and from DEI vendors for everyday and personal use,” Fullerton says, “but we’re not yet seeing the trend trickle as quickly into home goods, probably because home ownership is out of reach for so many. Popular categories are bags, drinkware and lunch items.”

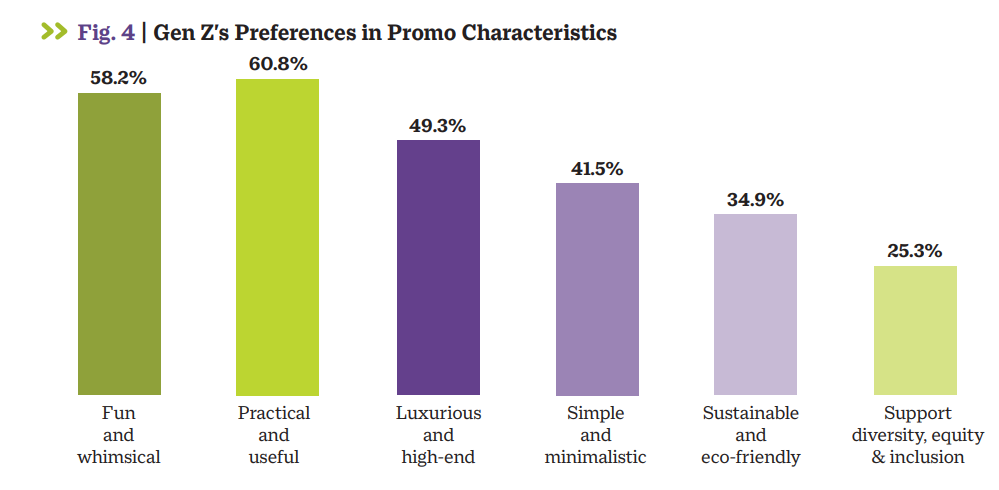

In terms of promo characteristics, 35% of Gen Z consumers prefer products that are environmentally responsible and 25% look for products that embody DEI (see Fig. 4). Plus, the 85% who view trendiness and cultural relevance as important suggest that keeping promo products culturally aligned and trendy is crucial for appeal.

“Gen Z buyers understand the intersectionality in ESG and DEI,” Wimbush says. “A truly sustainable product takes into account the welfare of the people who make it and live in the areas product components come from or are being made. Gone are the days of a sustainable product being solely based on eco-friendly materials.”

Embrace Digital

No surprise that a significant majority (70%) of Gen Z shows a strong inclination towards promotional products with digital and interactive components. Thus, incorporating non-fungible tokens (NFTs), augmented reality, QR codes and other digital elements could significantly boost the appeal and engagement of promotional items for this demographic.

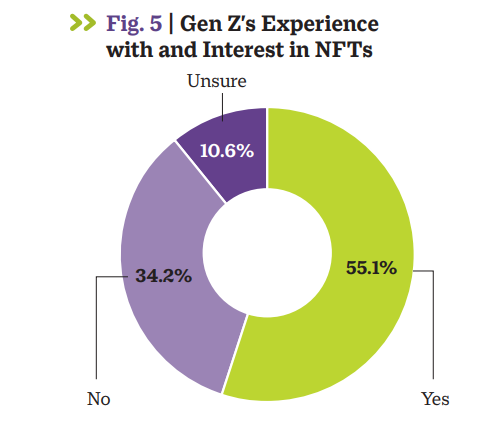

There are plenty of opportunities for promo firms to capitalize on the NFT trend. Although more than half (55%) of Gen Z consumers have expressed interest in receiving digital promotional products, only a little more than a third (34%) have received such items (see Fig. 5).

“In the realm of digital innovation, promotional products like NFTs are rapidly emerging as key tools to engage the Gen Z market,” Bhat says. “Forward-looking brands should seize this opportunity to integrate such cutting-edge digital elements, ensuring they stay relevant and appealing to this tech-oriented demographic.”

Perhaps more than any other demographic, Gen Z values personalization: 85% compared to 39% of consumers of all ages, according to PPAI’s 2023 Holiday Gifting Survey.

Incorporating customizable features, like adding names, can significantly boost the appeal and perceived value of promotional items, Bhat says. “Personalization in promotional products is a significant factor in enhancing Gen Z's satisfaction and connection with the brand,” he says. “Brands should leverage customization options to appeal more effectively to this demographic, fostering a sense of individuality and exclusivity.”