Transpacific Shipping Costs Slip As China’s Economy Stumbles

Export growth in China has softened as the country’s controversial zero-COVID strategy weighed on its economy. In a knock-on effect, lower exports out of China have, in part, played a role in reduced port congestion in the U.S. West Coast and helped bring down the cost of shipping goods from Asia.

Good News For Importers: China’s zero-COVID strategy is stalling export growth in the country. Shuttered factories and other disruptions stemming from its attempts to stop the spread of the virus cut April’s export growth to 3.9%, year-over-year. It’s the slowest growth pace since June 2020 and a sharp contraction from the 14.7% growth registered in March. The trade sector accounts for about one-third of China’s GDP.

Alan Murphy, CEO of market analysis firm Sea-Intelligence, noted in the company’s recent “2022-Q1 North America West Coast port volumes” report, “China’s continuing zero-tolerance policy towards COVID in 2022 have created an ever-present threat of port closures and operational restrictions, as seen at both Ningbo and Shanghai. Along with Chinese New Year, these restrictions will likely have eased some burden on the volume flows out of China, but likely also have created additional backlog.”

Just under a year ago, container rates coming from China spiked above $20,000 or more per forty-foot equivalent unit (FEU). Freightos, an online international freight marketplace, reports that container rates to the U.S. West Coast have fallen by more than 20% since the lockdown of Shenzhen in March. Rates remain significantly higher than the historic norm, but they’re well off their recent peaks.

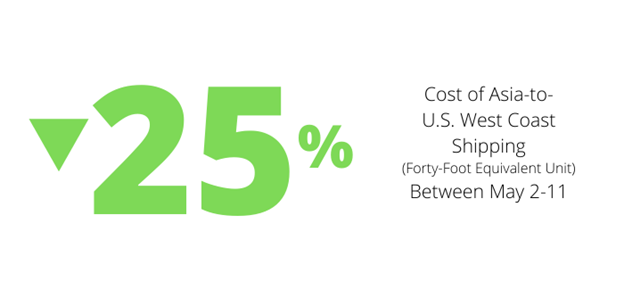

- Between May 2 and May 11, the Freightos Baltic Daily Index’s Asia-West Coast assessment—which includes premium charges—for a forty-foot equivalent unit (FEU) slipped 25% to $12,217.

- Maritime research and consulting firm Drewry issued its Shanghai-Los Angeles assessment the same week. It reported rates were down to $8,666 per FEU that same week, not including premium charges. This is 23% below levels reported in the third week of January and 30% below the index’s late-September record.

- On May 13, the Shanghai Containerized Freight Index, an index showing the most current freight prices for container transport from China’s main ports, registered its 15th consecutive weekly loss.

- The Platts Container Rate Index, part of S&P Global Commodities, issued its Asia-West Coast assessment and highlighted a decline to $8,000 per FEU, 16% below the index’s all-time high in February.

Asia-East Coast rates show a similar downward trend.

A Rattled Economy: Economic data coming out this week on April’s performance highlights factory output and consumer consumption at levels not seen since early 2020, at the start of the COVID-19 pandemic.

Economists and other observers point to China’s controversial zero-COVID strategy as a millstone around its economy’s neck.

- Data from China’s National Bureau of Statistics shows that industrial output slipped 2.9% in April from the year-ago level and retail spending in the country was down 11.1% in April year-over-year.

- The country’s unemployment rate climbed to 6.1% and the unemployment rate for young people—workers aged 16 to 24—hit a record 18.2% in April.

The economic price of the zero-COVID policy is also punishing many of the country’s macroeconomic indicators.

- Bloomberg Economics estimates that April’s gross domestic product is down 0.68% from a year ago, while UBS Group AG warns that GDP growth could be below 2% for the second quarter—S&P Global Ratings says it could be as low as 0.5%.

- Citigroup has downgraded its full-year growth forecast for China from 5.1% to 4.2%.