Market To Market: Bank On It

"Banks are dinosaurs,” Bill Gates famously stated in 1994. Fast forward 25 years and banks are hardly extinct. Since his prediction, bank operating revenue has tripled, earnings have quadrupled and equity has quintupled, according to the FDIC.

U.S. financial markets are the largest and most liquid in the world. The sector supports the world’s largest economy with the greatest diversity in banking institutions and concentration of private credit anywhere on the planet. In 2018, finance and insurance represented 7.4 percent (or $1.5 trillion) of U.S. gross domestic product.

The financial services industry, which includes banks and credit unions as well as various services, such as tax preparation, credit and accounting—is alive and well. Through this market, consumers can handle their financial needs, manage risk and build wealth. It’s a vital market that has come a long way since Alexander Hamilton founded the Bank of New York in 1784. Consumers can log into their bank accounts, put holds on cards, transfer money, view recurring charges and many more functions with a few taps on their phone screen.

In the future, the banking experience could include banks sending customers personal greetings on their smartwatches when they step into a branch. Deloitte projects that bank tellers may one day wear smart glasses that allow them to process customer banking information while simultaneously completing other customer-service tasks. While innovation in the financial sector continues, consumers are already enjoying an abundance of options. The U.S. is home to more than 4,600 banks, according to the Federal Reserve Bank of St. Louis. Consumers have seamless, real-time access to their funds—and they don’t even need to step foot in a physical branch.

To stand out in a competitive market, financial services companies must take stock of their marketing mix. It’s not enough to reach out with emails and postcards—companies must meaningfully connect with clients and prospects. In an industry where most transactions happen via a screen, promotional products provide a personal touch.

The financial market is the fourth largest user of promotional products according to PPAI’s 2018 Sales Volume Study comprising 6.4 percent ($1.5 billion) of the industry’s $24 billion market. Read on for a wealth of insights into the financial services market and some examples of promotional products that can help create memorable promotions for clients in this market.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The Solo Route Slim Brief from the New York Collection makes a smart gift from accounting firms and tax prep companies. This briefcase features a padded laptop compartment, an exterior zippered compartment and a back strap that slides over a luggage handle.

Logomark, Inc. / PPAI 110898, S12 / www.logomark.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Banks and credit unions can keep their logo visible in offices and on the go with the Vector Leak-Proof Tumbler. This double-wall, vacuum-insulated tumbler keeps drinks hot for eight hours and cold for 24 hours.

Leed's / PPAI 112361, S13 / www.leedsworld.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The Laguna Gel Pen offers an endless writing experience with an elegant design. Choose from a range of jewel tones with a color-matching rubber grip. A full-color imprint and chrome accents make this pen pop.

Goldstar / PPAI 114031, S7 / www.goldstarpens.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Financial services companies can stay on brand in boardrooms, offices and meeting rooms with the Marble Octagon Coaster. It's elegantly designed with rounded, smooth edges and no cork backing or rubber feet.

Webb Company / PPAI 143213, S7 / www.webbcompany.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Financial services companies can send a message of sweet appreciation with the eight-ounce Custom Chocolate Bar. It's available in milk and dark chocolate and packaged in a silver or gold gift box with a coordinating ribbon.

Chocolate Inn/Taylor & Grant/Lanco / PPAI 111662, S7 / www.chocolateinn.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Educate clients and provide value with the Debt-Free Living Key Points card. It's printed on quality cardstock with a gloss coating and folds to the size of a credit card.

Fields Manufacturing / PPAI 111951, S9 / www.fieldsmfg.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

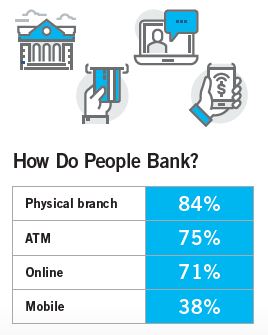

While the financial services industry is poised for future growth, it’s also in the middle of a digital revolution. Consumers are increasingly moving away from cash transactions in favor of digital payments. Roughly three in 10 Americans say they don’t make any purchases with cash in a typical week, which is up from 25 percent in 2015, according to Pew Research. When people carry cash, it’s usually not much. U.S. Bank found that 76 percent of Americans keep less than $50 on hand. About half of Americans have less than $20 in their wallets.

Considering that cash isn’t king anymore, you can expect to see fewer ATMs and brick-and-mortar banks around your community. Research from Expert Market predicts total extinction of bank branches and ATM locations by 2041.

Another trend to watch in this industry is a decline in customer loyalty. Americans are becoming increasingly more amenable to changing their financial services provider. Accenture found in a survey that 31 percent of banking customers would consider banking with Facebook, Amazon or Google if these companies offered the same kind of services they currently use. Financial technology firms such as Acorns and Robinhood are already capitalizing on this mindset by offering apps that support investing or other forward-thinking financial services. And Apple recently introduced its Apple Credit Card which combines cash-back rewards on purchases with a consumer-friendly app.

Younger consumers are especially agreeable to change. One in three Millennials say they’re open to switching banks in the next 90 days and about the same number say they will not even need a bank in the future, according to PwC.

Even though consumers are moving away from traditional banking, many still want the human interaction that comes with walking into a physical location. Marsh & McClennan found that one in four people don’t feel comfortable opening an account with a bank that doesn’t have a local presence. When people crave interaction, banks and financial services companies can use promotional products to reinforce a personal touch.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

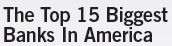

The largest 15 banks in the United States hold a combined total of $13.7 trillion in assets. For perspective, this wealth is enough to buy every person on the planet a 13-inch MacBook Pro—and still have money remaining for accessories. See below for the largest banks in the U.S. by assets.

- JPMorgan Chase & Co., $2.74 trillion

- Bank of America Corp., $2.38 trillion

- Citigroup Inc., $1.96 trillion

- Wells Fargo & Co., $1.89 trillion

- Goldman Sachs Group Inc., $925.35 billion

- Morgan Stanley, $875.96 billion

- U.S. Bancorp, $475.78 billion

- PNC Financial Services Group Inc., $392.84 billion

- TD Group US Holdings LLC, $384.07 billion

- Capital One Financial Corp., $373.19 billion

- Bank of New York Mellon Corp., $346.13 billion

- Charles Schwab Corp., $282.82 billion

- State Street Corp., $228.33 billion

- BB&T Corp., $227.68 billion

- SunTrust Banks Inc., $220.43 billion

Source: Bankrate

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

- Navy Federal Credit Union, $106 billion

- State Employees Credit Union, $40 billion

- PenFed, $24 billion

- BECU, $21 billion

- SchoolsFirst Federal Credit Union, $16 billion

- The Golden 1 Credit Union, $12 billion

- First Technology Federal Credit Union, $12 billion

- Alliant Credit Union, $11 billion

- America First Credit Union, $11 billion

- Suncoast Credit Union, $10 billion

Source: National Credit Union Administration

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

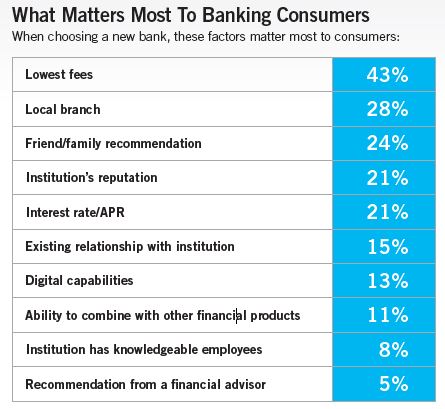

Source: Value Penguin

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

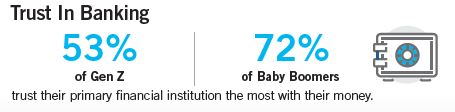

Source: Forrester Research

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

- 92% of Millennials choose a financial company based on their digital services.

- 83% of Millennials would switch to another financial product that offers better incentives than their current product.

- 82% of Millennials love financial products that offer them awards and savings.

- 44% of Millennials prefer to send money digitally.

- 44% of Millennials choose a financial product based on the new customer incentive.

Source: Digital Authority Partners

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Source: PwC 2019 Digital Banking Consumer Survey

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Executives at top-performing financial services firms are more likely than those at average firms to:

- Regard their reward and recognition programs as a competitive advantage (52 percent more likely)

- Believe that rewards and recognition are a critical tool in managing company performance (27 percent more likely)

- Strongly agree that their reward and recognition programs are effective retention tools (36 percent more likely)

Source: Incentive Research Foundation

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

- About 50% of all tax filers work with an accounting professional to file their tax returns.

- 83% of accountants say clients demand more today than they did five years ago.

- 67% of accountants feel that the profession is more competitive than ever.

- The global market for accounting software will reach $11.8 billion by 2026.

Sources: CBS News; Accounting Today; Sage

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

- Roughly 14.1 million adults don’t have a bank account. The top reasons include not having money and not trusting banks.

- The FDIC considers about 19 percent of American households to be underbanked, which means they have a primary bank account but use financial services such as pawn shops, check cashers and money transfer services.

- One in five Americans is “credit invisible,” which means they don’t have any kind of mainstream credit file.

Source: U.S. News & World Report

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The average American has $38,000 in personal debt, excluding home mortgages. Credit cards and mortgages are tied as the leading source of debt, followed by student loans and car loans.

23 percent of Americans have tapped into their retirement savings early in order to pay off debt.

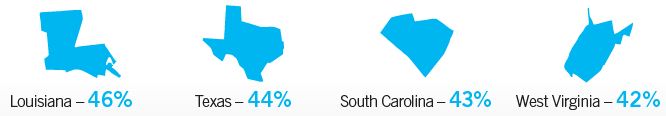

In the United States, 71 million adults have debt in collections. Most of these people live in the South. The states with the highest share of residents with debt in collections are:

Sources: The Urban Institute; Northwestern Mutual; Magnify Money

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

To remain competitive in the financial services market, companies must focus on providing an exceptional client experience. This doesn’t mean offering more digital tools or more robust apps. Companies must strive to make banking personal again. Here’s how promotional products can help.

Add an element of delight. While the role of the brick-and-mortar branch is evolving, a physical branch is still an important part of the banking experience for many consumers. When consumers visit a bank or credit union, employees can take their experience to the next level by offering a personalized thank-you note and a promotional gift. It’s a small gesture but it goes a long way in terms of customer retention.

Create a VIP program. Credit unions can inspire members to keep using their services by offering a VIP program, complete with a thoughtfully selected promotional product upon signing up. Like a loyalty program, members receive benefits such as fee refunds or certificate dividend bonuses. Keep members engaged in the program by offering different levels of promotional gifts.

Customize the conversation. When financial services firms take the time to understand customers’ needs, preferences and behaviors, they can become a true partner for the customer. Whether individuals meet with their bank about mortgage loans or college savings, the bank could follow up with detailed information along with a relevant promotional product.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Audrey Sellers is a Dallas, Texas-area writer and former associate editor of PPB.